The road to stakeholder capitalism begins with diverse boards

- Stakeholder capitalism aims to ensure that economies improve society and protect the planet.

- We need diverse leadership on the board to reflect the diverse interests of stakeholders.

- Investors, regulators and boards of directors are thinking beyond “profit at all costs”, but more can be done.

The era of stakeholder capitalism has arrived. The question is, how do companies move from an exclusive focus on financial performance for shareholders to generating shared value for shareholders and other stakeholders? How to make stakeholder capitalism more fully experienced and felt.

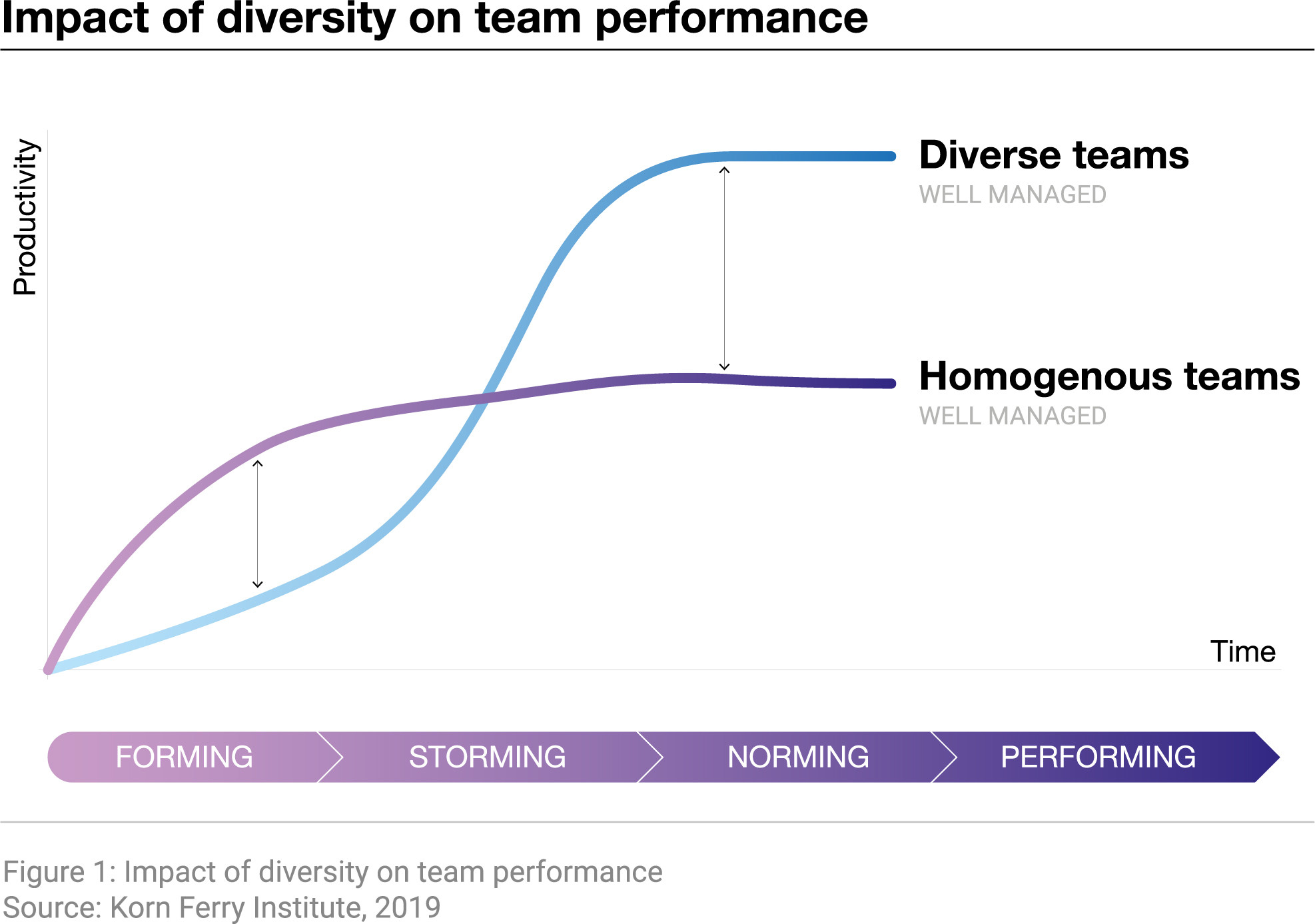

I believe the road begins with boards of directors. Specifically, a high quality, diverse and independent board of directors that can navigate different priorities and horizons among constituencies. I use the word diverse in its broadest sense: a definition that begins with non-uniformity of thought and encompasses race and ethnicity, sex and sexual orientation, religion and age, geographic and socio-economic origins, and more.

Various boards work better

A Harvard Business School study found that women bring to the board a different set of perspectives, experiences, angles and points of view than their male counterparts. Likewise, a McKinsey study found that companies in the top quartile for gender diversity in executive teams were 25% more likely to have above-average profitability than companies in the fourth quartile. When it comes to ethnic and cultural diversity, McKinsey found that companies in the first quartile outperformed those in the fourth quartile by 36% in terms of profitability.

The COVID-19 pandemic and recent social and political unrest have created a deep sense of urgency for businesses to actively work to tackle inequality.

The work of the Diversity, Equality, Inclusion and Social Justice Forum is driven by the New Economy and Society platform, which focuses on building prosperous, inclusive and just economies and societies. In addition to its work on economic growth, recovery and transformation, work, wages and job creation, and education, skills and learning, the platform takes an integrated and holistic approach to diversity, equity, inclusion and social justice, and aims to address exclusion, prejudice and discrimination related to race, gender, ability, sexual orientation and all other forms of human diversity.

The platform produces data, standards and information, such as the Global Gender Gap Report and the Toolkit for Diversity, Equity and Inclusion 4.0, and drives or supports initiatives actions, such as Partnering for Racial Justice in Business, The Valuable 500 – Closing the Disability Inclusion Gap, Hardwiring Gender Parity in the Future of Work, Closing the Gender Gap Country Accelerators, Partnership for Global LGBTI Equality, Community of Chief Diversity and Inclusion Officers and Global Future Council on Equity and Social Justice.

While these studies suggest that boards should view business strategy through the lens of various stakeholder interests, it is incumbent on boards to reflect these constituent groups in their own organizations.

Regulators and businesses pay attention

The NASDAQ Board of Directors Diversity Rule, approved by the Securities and Exchange Commission (SEC) in August 2021, is a disclosure standard designed to foster board diversity and provide greater transparency to stakeholders . In 2020, Goldman Sachs – one of the largest underwriters of initial public offerings – announced that it would not bring companies public in the United States or Western Europe if they did not have at least one member. diverse board of directors. In July 2021, the company doubled this requirement to two, one of whom must be a woman. Another example is the Fearless Girl campaign of State Street Global Advisors, our asset management company, which started in 2017, and which aims to promote and advance gender representation on boards of directors. enterprises.

How can boards of directors advance diversity, equity and inclusion?

Recently, State Street Global Advisors partnered with Russell Reynolds Associates and the Ford Foundation to glean best practices for boards of directors on how to advance racial and ethnic diversity, equity and inclusion ( DEI). We’ve highlighted three key recommendations below (see the image for the full list):

- Build a board of directors with various directors who have experience in monitoring DCI. Boards should prioritize DCI in their director recruitment efforts, both to improve the diversity of the board itself and to recruit directors who understand the importance of overseeing DCI within the board. business. As boards of directors are renewed regularly, it is essential to recruit directors who value a diversity of points of view.

- Make racial equity an active part of company strategy and culture, and work towards clear, quantitative KPIs. As one director put it, “You have to get the board to treat DEI like any other important part of strategy – we shouldn’t treat this any differently from any other business process. “

- Make DCI both a strategic and a tactical responsibility. Boards should approach DCI at the board level as a strategic conversation, but also in committees at a tactical level.

Companies with ESG credentials are more resilient

The crises of the past two years have highlighted the interdependence of stakeholders and argued for a multi-group approach. Investors sit down and take note, as the performance of ESG stocks during the pandemic shows. Although fund performance varies and should be assessed on an individual basis, the overall picture presents a compelling argument that companies with superior ESG practices exhibit greater resilience and preserve long-term value more effectively than their peers by period of market stress.

It is important to note here that most investors, such as pension funds and sovereign wealth funds, have long-term commitments that they must honor on behalf of their clients. These liabilities span years and in some cases decades, so it is essential for these investors to invest with a focus on long term returns and preservation / creation of value.

Dashboard for a new economy. Source: World Economic Forum.

While the pandemic has highlighted the notion of stakeholder capitalism, part of this conversation highlights historic shifts from tangible to intangible assets. In the past, markets and investors measured company value using conventional financial criteria developed for asset-intensive companies. This approach, however, no longer captures the full picture of value – both in terms of risk and opportunity – because today it is often a company’s intangibles that are the real drivers of value. . Consider some tech and software companies: what are their significant hardware assets?

The growing acceptance of ESG in the financial industry shows that investors are starting to recognize the intangibles we all depend on. This new recognition and pricing of the integral things that matter – including natural, human and social capital – underscores the interdependence of stakeholders and the need for boards of directors to reflect this larger vision.

Go from shareholder to stakeholder

Milton Friedman said in 1970 that in a free market, state-owned enterprises exist “only to serve shareholders.” He also cautioned against allowing companies to outsource costs to the company. Shareholder interests remain important today, but climate change, technological upheaval, a more closely interwoven global economy and growing income inequality are illustrations of these externalities. No company – and certainly not publicly traded ones – exists in a vacuum.

This change in mentality is not trivial. This represents a shift in focus from maximizing short-term returns towards goals that help ensure long-term value creation, including building resilience, increasing DEI, and paving the way for net-zero. . Imagine a camera opening opening to reveal a close-up of a quarterly return and gradually widening to show a company’s factory, its shipping hub, the community charity where its employees donate. volunteering, the supply chain, the carbon footprint and finally its environmental vulnerabilities.

Putting this larger vision into practice begins with boards of directors capable of seeing, hearing, appreciating and thoughtfully weighing the needs of several constituents. Competent and diverse board leadership can help companies overcome myopia and broaden their vision for the benefit of all.