Ministers and business leaders agree deals and discuss opportunities at Saudi-Caribbean investment forum

DUBAI: In 2020, headlines around the world proclaimed the “death of the city” and predicted a widespread urban exodus caused by the pandemic. Yet while many city dwellers have abandoned the urban streets in search of greener pastures, many have stayed and even more are returning in droves, drawn to the vibrant, cosmopolitan lifestyle that only the world’s largest cities can offer.

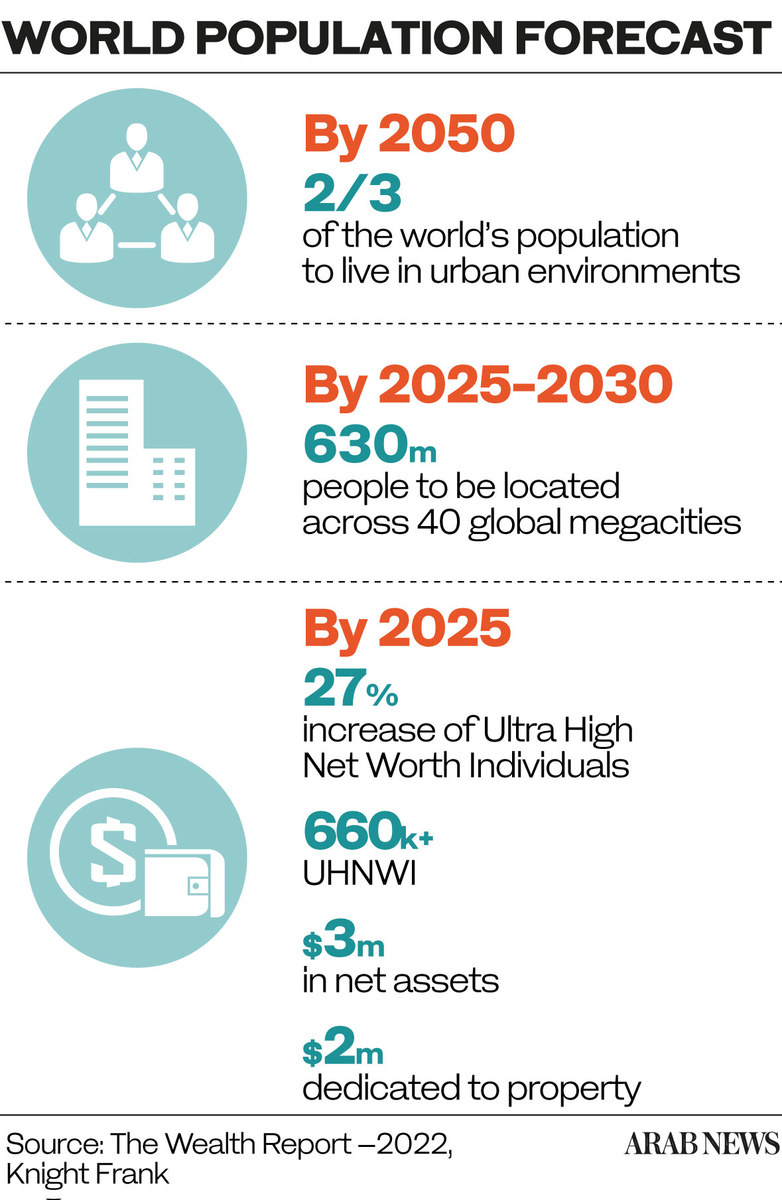

As the world’s cities come back to life, the prediction that two-thirds of the world’s population – nearly seven billion people – will live in an urban environment by 2050, including 630 million in 40 global megacities by 2025- 2030, remains valid.

However, not all cities are created equal, with vast gaps evident in quality of life, safety, healthcare provision and affordability.

While real estate markets everywhere have softened during the pandemic, the last twelve months have seen a resurgence.

In particular, blue-chip global markets have seen an uptick in volume and value, driven by the world’s wealthiest who seek to minimize risk by diversifying their portfolios with increased investments in real estate, which is widely considered as a safer and more tangible asset class.

The global population of ultra-high net worth individuals is expected to grow by 27% by 2025, which will see over 660,000 individuals each with $30 million or more in net assets. And since about two-thirds of this wealth is typically tied to real estate, the outlook for major capital stocks in global gateway cities is overwhelmingly positive.

Dubai Market Snapshot

Despite being widely perceived as a seller’s market, residential real estate in Dubai remains affordable, with a capital value of $630 per square foot, significantly lower than comparable global gateway cities.

In addition, residents benefit from a very high quality of life, a safe environment, a moderate cost of living and a low property price to income ratio.

Dubai’s residential real estate market rebounded in 2021, recording 85,000 residential real estate transactions with a total value of AED300 billion, representing a 65% increase in transaction volumes and a 71% increase in value compared to the previous year.

Villa sales have done particularly well since the pandemic, rising by an average of 22% as buyers seek access to private outdoor space and the benefits of community facilities. However, there is still plenty of room for growth in the medium to long term, with the residential market currently down 29% from its peak in 2014.

In Dubai, the high end is seeing strong demand, especially for super premium villas, whose sales last year reached their highest level since 2015.

According to Knight Frank, 93 homes worth over $10 million were sold in Dubai in 2021, more than in the previous five years combined. In addition, the super-prime segment posted an annual capital value growth rate of 17% in 2021, which is still below the market peak of December 2014.

Compared to other global gateway cities, Dubai remains significantly undervalued and therefore offers strong appeal to ultra-high net worth individuals seeking global property investments with significant room for growth in an increasingly favorable to foreign direct investment and offers an excellent quality of life. Going forward, the price acceleration will be fueled by growing demand and a scarcity of super-prime properties on the market.

London market overview

In London, prime real estate remains around 20% below levels seen in the peak period of 2014, with growth expected to remain slow due to post-Brexit uncertainty, rising mortgage rates by lenders and the resumption of stamp duties. In fact, Savills, the UK’s leading property services company, forecasts a growth rate of around 4% this year, rising to 13.7% by 2026.

For most residents, affordability remains a significant barrier to homeownership as growth outpaces wage inflation and a high house price-to-income ratio of 14.51 persists. Additionally, residents of London are burdened with a high cost of living with the added disadvantage of a moderate quality of life.

At the high end of the market, however, the outlook is very different, with buoyant sales in the super-prime sector driven by high-net-worth domestic and UK-domiciled individuals looking to capitalize on stagnant values to improve size. of their homes, amenities and location.

Hawazen Esber, CEO of Majid Al Futtaim — Communities

Savills reports that the fourth quarter of 2021 saw the best performance ever for deals in properties valued at over £10m.

New York Market Snapshot

The US economy grew by around 6% in 2021, a significant rebound from the 3.4% contraction recorded the previous year. As Wall Street profits soared, the economy got back on track, and New York City reopened, the real estate market began to recover.

2021 turned out to be a banner year for residential sales in New York, despite an initial slowdown at the start of the pandemic and a mass exodus – 320,000 people left the city in 2020, an increase of 237% compared to the previous one. year.

The average cost of an apartment in Manhattan is $1.95 million, and the median price rose 11% in Q4 2021. While city dwellers currently enjoy a moderate price-to-income ratio , the cost of living is very high, and the quality of life is average.

In the super-prime market, New York is one of the best performing countries in the world, with sales in 2022 exceeding US$10 million recorded in 2021; the segment is also changing rapidly, with homes taking an average of 97 days to sell. In the same year, Manhattan recorded a total sales value of $30 billion, more than half of which was in the form of cash transactions, as HNWIs sought to mitigate their potential exposure to risk by diversifying their assets and strengthening their portfolios. real estate in the United States. States.