Energy Stock Forum: Growth in demand and bookings can accelerate returns (FET)

shotbydave

FET is on a brighter path

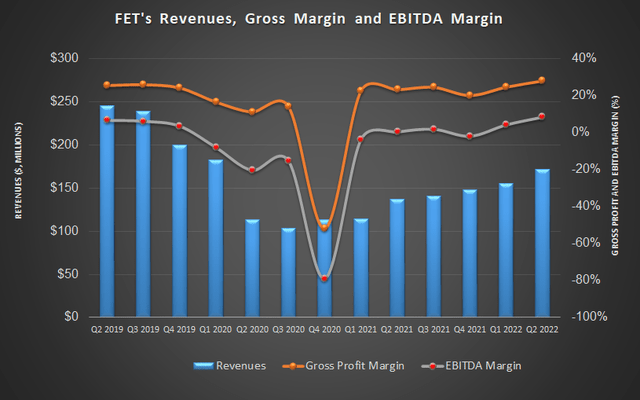

Energy Technology Forum (New York stock market :NYSE: FET), an oilfield services company, provides products and services to upstream companies engaged in drilling and downhole, completion and production operations. I discussed FET strategies and value drivers in my previous article. Currently, the company’s powerline cables used in zip and simul-frac operations and drilling product lines offering mud pump consumables are in high demand. Much of the growth in orders was due to oil service companies replacing capital components with consumable items and investing in equipment upgrades and new construction.

While cash flow was negative in the first half of 2022, it recently sold inventory and assets for one of its non-core drilling products. With lower working capital requirements, it expects to generate free cash flow in 2H 2022. Although the debt ratio is high, it can deleverage if the convertible debt mechanism is triggered (c i.e. if a specific share price is reached). Investors can expect strong returns and may consider buying the stock.

Strategic direction

Looking for Alpha

A few years ago, FET management readjusted its strategy to maintain a lean cost structure. Since then, it has focused on pursuing markets with a significant presence and can market its products. Since the energy market downturn of 2020, many oil service companies have replaced capital components with consumable items, allowing them to keep pace with the industry. Many invested in gear upgrades, while others also added new builds. As drilling activity resumes in the United States, FET will seek opportunities with its portfolio of consumables and equipment.

The number of land rigs in the United States has not changed much since the second quarter. The number of wells drilled has increased by 34% since the beginning of the year, EIA. On the other hand, DUC wells decreased by 12% during this period. Overall, energy market indicators point to an increase in activity in the United States.

Current booking growth and drivers

Through innovation in borehole design, it won new customers and gained market share in the second quarter. In consumable and replacement items, FET will seek to meet the demand for the demand completion business through its corded, conventional and greaseless cables. Power line cables are typically used in zipper and simul-frac operations. The drilling product line offers consumables for mud pumps. These products, according to management, have increased operational efficiency compared to competitors’ products.

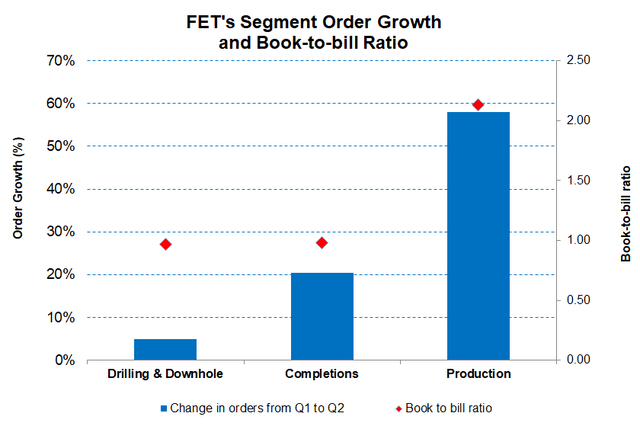

Due to these new offerings and increased market demand, FET valve bookings increased sequentially by 26% in the second quarter, following a 35% increase in orders from upstream and midstream customers. In addition, production equipment reservations increased by 58% between the first and second quarters. One of his most important orders came from the Marcellus Shale. It received an order for electrostatic processing technology equipment in the Middle East. The new orders will support its 2022 revenue and improve revenue visibility in 2023.

Guidance Q3 2022

Higher industrial activity is likely to impact the demand for FET products and services. FET’s book-to-bill ratio was 1.18x in the second quarter. So, with an orders-to-bill ratio above one, management expects its Q3 revenue to grow 2% (at the midpoint of guidance) from Q2. Adjusted EBITDA may swell by 20% in Q3.

For fiscal year 2022, management kept its annual EBITDA estimate unchanged at $50 million to $60 million, 175% higher than for fiscal year 2021. In the second quarter, its incremental EBITDA margin was $38 million. %.

Second Quarter Segment Value Drivers

Company deposits

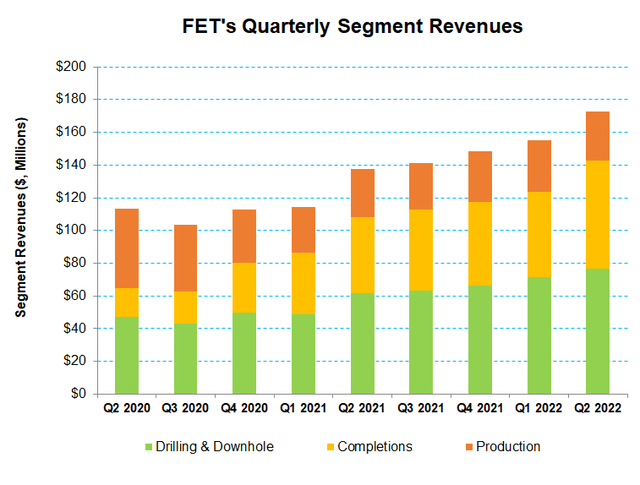

Drilling and downhole segment

Revenue increased 7% in Q2 2022 compared to Q1 2022. Price increases across the drilling product line and a favorable mix boosted operating margin in Q2. Quarter-over-quarter, the segment’s order increased by approximately 5% as it received an order for two drilling walkways from a contractor in the Middle East.

Achievements Segment

Revenue growth was strong (+26% quarter over quarter) in the second quarter. Increased demand for short-cycle consumables and improved performance resulted in better performance in this segment. Revenues from coiled tubing and wireline cables were the main drivers of improved segment performance.

Company deposits

Manufacturing segment

This segment experienced a decline in revenue (by 5%) in the second quarter compared to the previous quarter. Despite this, the strong growth in the order book (58% more) during this period may boost performance over the remainder of 2022.

Cash flow and debt

The company’s cash flow turned negative (-$51 million) in the first half of 2022 compared to a year ago. Although revenue increased year over year, an increase in inventory and accounts receivable balance resulted in lower cash flow. Management expects net working capital to decline in the second half of the year. It recently sold inventory and assets for one of its non-core drilling products. Thus, he expects free cash flow to be between $30 million and $40 million at 2H 2022 instead of negative FCF at 1H 2022.

FET’s liquidity stood at $141 million as of June 30, 2022, while its leverage ratio was 0.87x. Most of its total debt is convertible into stock at $30 per share. A conversion can increase the value of the company and significantly lighten the balance sheet.

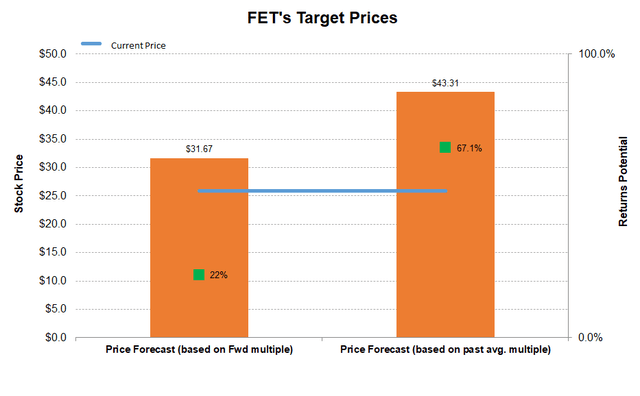

Forecast based on linear regression

To understand how revenue would change over the next few years, I developed a regression model based on the relationship between the price of crude oil, US completion wells, wells drilled, and FET revenue over the past seven years. I also looked at short-term earnings (four previous quarters). I expect its revenue to increase by around 13% over the next two years before declining in the NTM (or next 12 months) of 2025.

I’ve developed a similar model for EBITDA, but with a simpler assumption that it’s revenue-based only. Based on long and short term trends, I expect the company’s EBITDA to increase by almost 200% in NTM 2023. It could slow down and almost double in NTM 2024.

Target Price and Returns

Created Author, TIKR.com and looking for Alpha

The EV/Average Income multiple produces a 67% upside (from current price) in the stock. This is higher than the return potential using the EV/Term Income multiple (0.60x) (up 22%). Here I used EBITDA for NTM 2023 and assumed EV would remain unchanged.

Why Upgrade FET?

FET continues to track an evolving asset-light base with expectations of steady medium to long-term operating profit growth. In my previous article, I was reasonably bullish on the outlook for FET, but stopped short of a bullish thesis, suggesting “hold”. In the article I wrote:

New platforms in Latin America and the Middle East have also led to higher international awards for the company. The stock is reasonably valued relative to its peers. However, supply chain constraints may reduce operating margin expansion.

In the second quarter, FET valve bookings increased sequentially by 26%, while production equipment bookings increased by 58% between the first and second quarters. Much of the growth in orders was due to oil service companies replacing capital components with consumable items and investing in equipment upgrades and new construction. This can quickly be a game-changer in FET’s favor. The company’s cash flow can benefit enormously. So, I’m confident in a “buy” rating for the stock.

What is the take on FET?

Looking for Alpha

The pricing environment is tightening as the company’s customers push prices as their demand for such services increases. FET order booking growth in production equipment bookings was strong from the first to the second quarter. The growth of its valve bookings has not lagged far behind during this period. The drilling fluid end module and valve product line may continue to see net price gains. However, prices are still below the 2019 level.

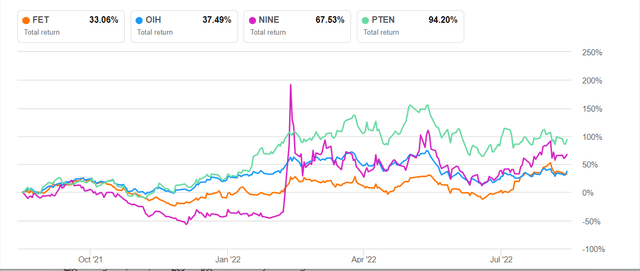

The stock has performed nearly in line with the VanEck Vectors Oil Services (OIH) ETF over the past year. Although cash flow was negative in the first half of 2022, management expects to turn around the situation through lower working capital requirements and inventory sales. Although the debt ratio is high, it has sufficient liquidity which makes its balance sheet healthy. Given the potential return from changes in relative valuation multiples, you might consider buying the stock at this level.