A forum discusses the prospects of the new regime

gustavofrazao/iStock via Getty Images

Transcription

We brought together senior investors from BlackRock to discuss the outlook for the rest of the year.

1) A new market environment

It has been widely recognized that this diet is different because it relates to the macro, as it relates to the markets. In a supply-driven macroeconomic environment, the trade-off between growth and inflation is so much more difficult. And the politicization of everything also makes decision-making much more difficult. And all of that means Goldilocks (steady growth and low inflation) is off the table, and buying the dip as an investment trade idea doesn’t quite apply either.

2) Portfolio 60% equities / 40% bonds revisited

The second observation is around this idea that, well, the typical 60/40 portfolio doesn’t work quite as much. If you think about 2022, that’s actually the worst year on record for a 60/40 portfolio, and also as we think about hedging some of that macro risk that’s very, very difficult, the risk models calibrated to the history need to be reviewed.

3) Bigger and more portfolio changes

And the third observation is around this idea that in an environment where we have higher macroeconomic volatility, higher market volatility, more frequent and potentially larger and more dynamic adjustments to portfolios will be warranted.

______________

Worries about global growth and inflation are keeping investors awake. This backdrop made for a lively gathering at our June 14-15, 2022 Outlook Forum, a semi-annual meeting we host for BlackRock portfolio managers and executives. We argued that we were entering a new macroeconomic and market regime and debated the implications at our first in-person forum since the pandemic hit in early 2020.

A historic shift

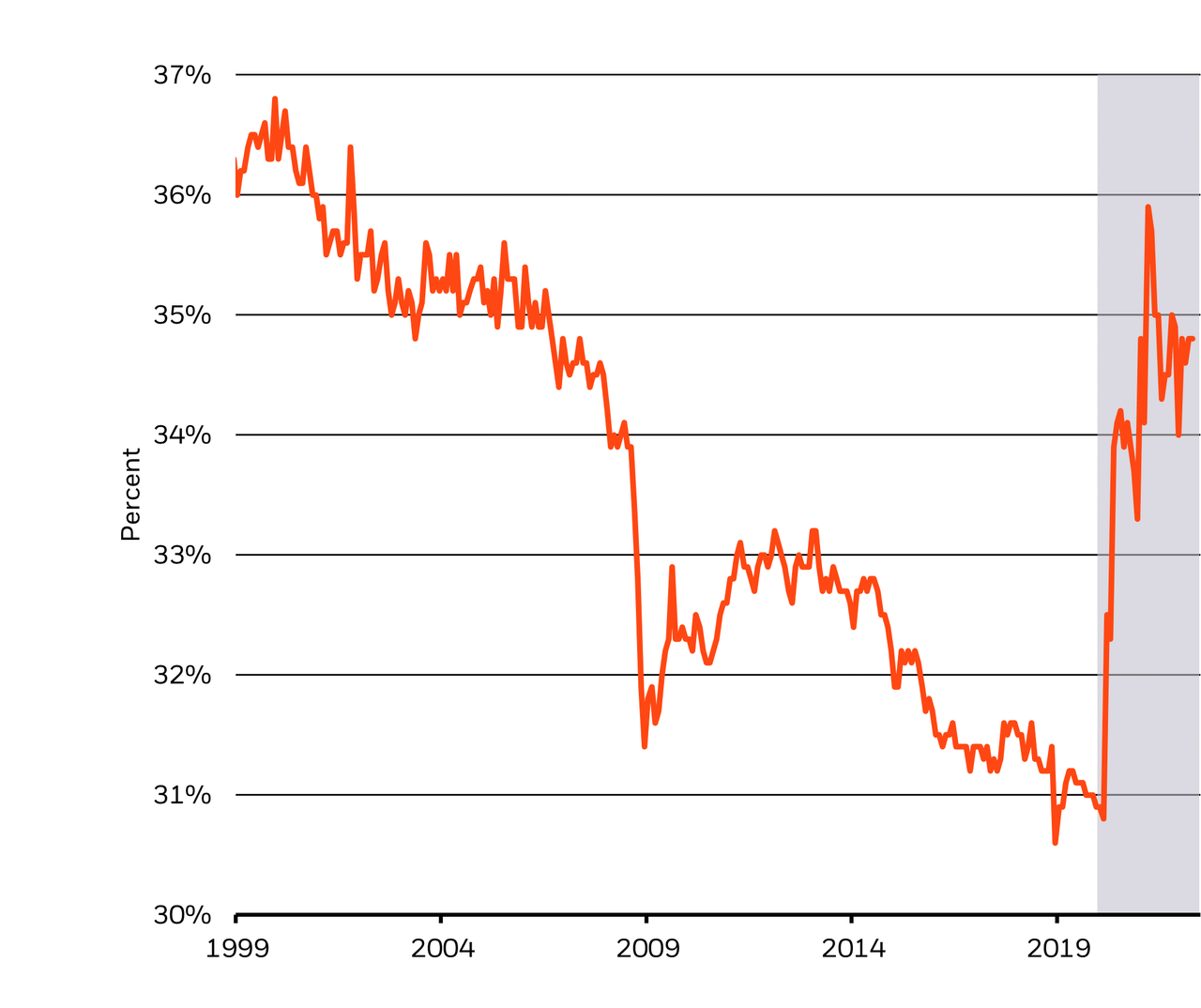

Nominal share of US goods in consumer spending (BlackRock Investment Institute, US Bureau of Economic Analysis, with data from Haver Analytics, June 2022)

Notes: The chart shows the share of US goods in nominal personal consumption expenditure from 1999 to 2022.

Many forum discussions focused on the production constraints driving the current inflation. The pandemic has triggered a massive shift in consumer spending toward goods and away from services. See the shaded area in the graphic. This reallocation occurred as shutdowns limited production and movement – and led to a sectoral reallocation of resources. The rebound in economic activity has unleashed pent-up demand for services, creating a conspicuously tight labor market. The war in Ukraine has added an additional shock to commodity prices. These factors pushed inflation to its highest level in 40 years. Almost all Forum participants said that average US inflation would stand above the Federal Reserve’s 2% target over the next five years. This was a marked change from our November outlook forum, where only half anticipated this. Participants were divided on how companies will adapt to this new environment – and whether they can maintain historically high margins despite rising input costs and the need to diversify supply chains in a more fragmented world.

Worries over a slowdown in global growth weighed on participants as a rush by central banks raised rates in a bid to rein in inflation – all within the week of the Forum. Half of participants saw the restart stagnate over the next two years, leading to a short and shallow global recession, up significantly from November 2021. Declining US growth was in focus as the risk of excessive tightening by the Fed was increasing. The wave of central bank rate hikes has shown that many are unaware of the crushing effect this will have on growth, in our view, and we are now seeing the US restart of economic activity stalling.

Signs of a new regime

A rapidly changing world complicates matters. The war in Ukraine has exacerbated the high inflation caused by restart supply disruptions – and caused a sharp rise in commodity prices. Commodity prices are likely to remain high, Forum speakers said. Why? Weaker production capacity after years of underinvestment as well as growing demand for industrial metals needed to transition to net zero carbon emissions by 2050. The outperformance of traditional energy assets this year does not mean that the transition is reversing, the speakers said. This reflects higher expected profits for companies replacing Russian energy supply. We believe that energy consumption in the coming decades will be very different, and low-carbon fossil fuels have an important role to play in enabling the transformation.

Geopolitical fragmentation is another tenet of the new regime, and the war in Ukraine has accelerated it. The Forum focused on how many emerging market countries (EMs) are now trying to find common ground between the US and China or trying to play against each other. EM isn’t what it used to be anyway. The name itself is a misnomer, as it hides an incredibly diverse set of countries. The old approach of seeking growth and cheap assets in emerging markets is outdated, Forum participants argued. Now it’s about quality investments, earning potential and finding friend-shoring beneficiaries. Another change: Emerging markets’ dependence on China is decreasing, mitigating some of the effects of China’s lockdowns to prevent the spread of Covid-19.

The road ahead

So how should investors adapt to all of this? Ignore macro risks at your peril. Most participants said they expected to see short cycles, greater macro volatility and volatile markets. They highlighted the need to make faster portfolio changes amid shrinking investment horizons and also prioritize liquidity. Participants also questioned the classic portfolio construction configuration of 60% stocks and 40% bonds. A 40-30-30 split – including traditional fixed income, public equities and private assets – is perhaps more appropriate in the new regime. Simply betting on the mean reversion or buying the dip will no longer work, many agreed.

Market backdrop

Weak global PMI data reinforced fears of a slowdown, capping the rise in yields and triggering a rebound in equities from 2022 lows. UK inflation hit a four-decade high of 9.1%, increasing pressure on the Bank of England (BoE) to react aggressively with further tightening. Many developed market (DM) central banks have made rapid rate hikes without recognizing how much they could hurt economic activity. In our view, not recognizing political trade-offs increases risks to growth.

Inflation and survey data will be the focus this week. In the US, an update on the Fed’s preferred PCE inflation measure will determine whether inflationary pressures begin to ease amid any easing in business surveys. Inflation data from the Eurozone will likely reinforce the ECB’s resolve to tighten policy in July. While we see the ECB hike rates significantly in upcoming meetings, the weight of the energy shock hitting Europe will ultimately force it to rethink its hike cycle.